As the 2026 tax season approaches, many Americans are preparing to file their federal income tax returns and are already thinking about their refunds. For many households, a tax refund provides helpful financial support for paying bills, building savings, or covering large expenses. While no exact refund date is guaranteed for every person, understanding how the system works can help set realistic expectations.

A tax refund happens when you pay more federal income tax during the year than you actually owe. This usually occurs through paycheck withholding, where part of your earnings is sent to the government. When you file your tax return, your total income is calculated and deductions and credits are applied. If the amount already paid is higher than your final tax bill, the extra money is returned to you.

Refund amounts vary for each taxpayer. Income level, tax withholding, and eligibility for credits all affect the final number. Credits such as those related to children, education, or low-to-moderate income can significantly increase a refund. Changes in income, job status, or family situation may also cause refunds to be higher or lower compared to previous years.

यह भी पढ़े:

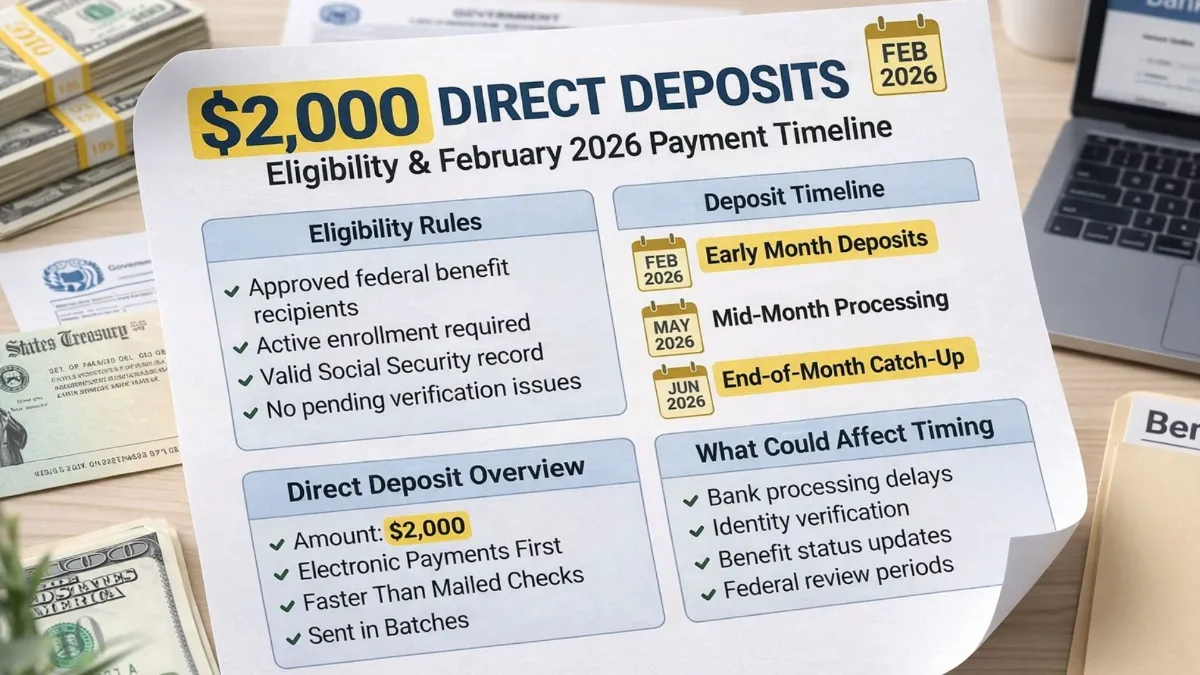

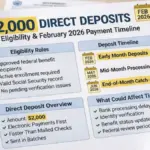

$2,000 Direct Deposit February 2026 Explained: Eligibility Criteria, Payment Timing, and Updates

$2,000 Direct Deposit February 2026 Explained: Eligibility Criteria, Payment Timing, and Updates

The tax filing season usually opens in the second half of January. Once returns are officially accepted, they begin moving through IRS processing systems. Taxpayers who file electronically and choose direct deposit often receive refunds within about two to three weeks after their return is accepted. Filing early and submitting accurate information can help reduce delays.

The method used to file plays an important role in timing. Electronic filing is generally much faster than mailing a paper return because the information enters IRS systems immediately. Paper returns require manual handling, which can add several weeks to processing time. Choosing direct deposit instead of a mailed paper check also speeds up delivery and reduces the risk of lost payments.

Some refunds may take longer due to errors, missing forms, identity verification checks, or high filing volume periods. Even small mistakes, such as incorrect Social Security numbers or bank details, can slow down approval. Reviewing your return carefully before submission can help avoid these delays.

Taxpayers can track their refund status using the official IRS online tool, which shows when a return is received, approved, and sent.

Disclaimer: This article is for informational purposes only and does not provide tax, financial, or legal advice. Refund amounts and processing times depend on individual tax situations and official IRS procedures. For accurate guidance, consult official IRS resources or a qualified tax professional.