The 2026 tax season is approaching, and millions of Americans are preparing to file their 2025 federal income tax returns. For many households, a tax refund is not simply extra cash. It often helps cover rent, utility bills, school expenses, or other important costs after the holiday season. Understanding how the refund process works can reduce confusion and make financial planning easier.

The federal tax filing system usually opens in the final week of January. In 2026, returns are expected to be accepted around that time. Although taxpayers can prepare their forms earlier using tax software or professional services, the IRS cannot begin processing returns until the official opening date. Submitting early simply places the return in line.

The filing deadline for most taxpayers will be April 15, 2026. While filing near the deadline is allowed, waiting until the last weeks can sometimes lead to slower processing due to high return volumes. Filing earlier in the season can help avoid heavy traffic and gives taxpayers more time to fix any issues.

यह भी पढ़े:

IRS Tax Refund 2026 Schedule: Expected Dates, Refund Amounts, and Processing Time Explained

IRS Tax Refund 2026 Schedule: Expected Dates, Refund Amounts, and Processing Time Explained

There is no single refund calendar that applies to everyone. Each return is reviewed individually. The timing of a refund depends on how the return is filed, how the refund is requested, and whether the information is accurate. Electronic filing is generally faster than mailing a paper return because digital submissions move through automated systems. Paper returns require manual handling, which can add several weeks to processing time.

Choosing direct deposit is usually the fastest way to receive a refund. Once a return is approved, funds are sent electronically to the taxpayer’s bank account. In many cases, direct deposit refunds arrive within about three weeks after the return is accepted. However, banks may take one or two business days to post the funds.

Some tax credits require additional review. Returns claiming certain income-based or family-related credits may not be fully processed until mid-February. This extra review helps prevent fraud and identity theft. While this can delay payment, it is part of standard security procedures.

यह भी पढ़े:

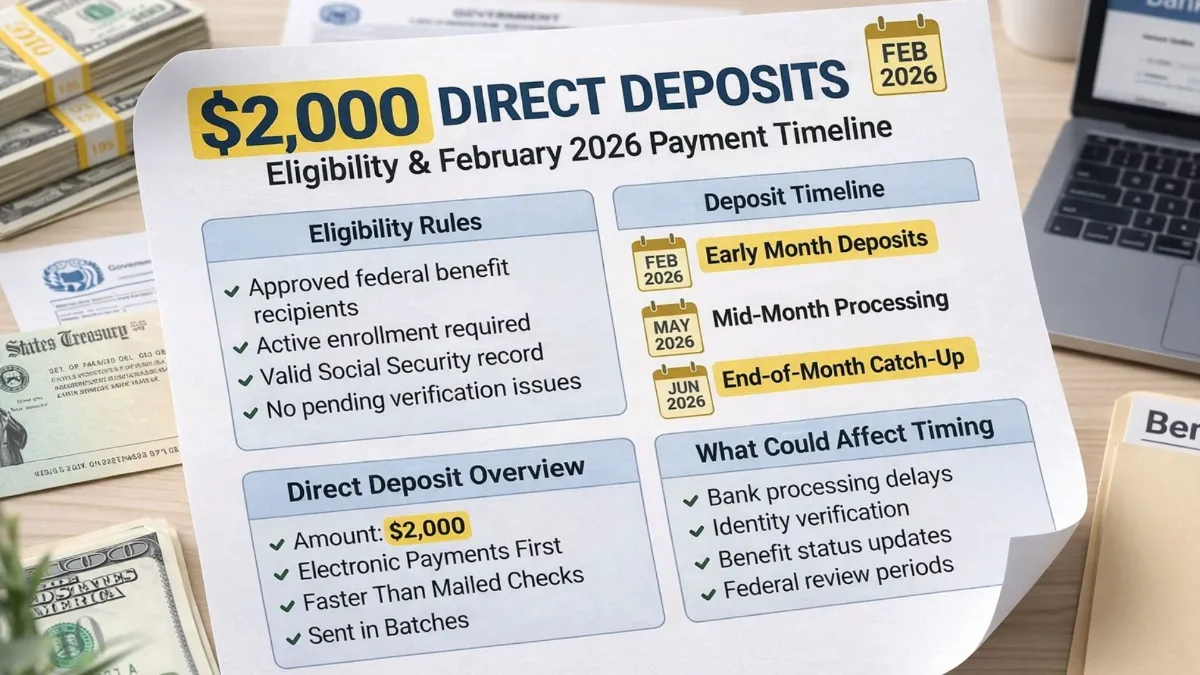

$2,000 Direct Deposit February 2026 Explained: Eligibility Criteria, Payment Timing, and Updates

$2,000 Direct Deposit February 2026 Explained: Eligibility Criteria, Payment Timing, and Updates

Errors such as incorrect Social Security numbers, wrong income amounts, or missing forms can also cause delays. Reviewing all details carefully before submission can help avoid problems. Taxpayers can track their refund status using the official IRS online tool, which shows updates after acceptance.

Disclaimer: This article is for informational purposes only and does not provide tax, legal, or financial advice. Tax deadlines, refund timelines, and eligibility rules may change. Each taxpayer’s situation is different. For accurate guidance, consult official IRS resources or a qualified tax professional.