The 2026 tax filing season has officially started, and many Americans are paying close attention to their expected refund amounts. With living costs still high, tax refunds remain an important source of financial support for families. Recent statements from the White House have suggested that average refunds for many taxpayers could increase by $1,000 or more this year, which has added to public interest.

The Internal Revenue Service opened the filing season on February 26, 2026. Taxpayers who had more federal income tax withheld from their paychecks than they actually owed may qualify for a refund. In addition, individuals and families with low or moderate incomes may still receive money back through refundable tax credits, even if they owe little or no federal income tax. For this reason, filing a tax return can be important, even for those with limited earnings.

The IRS has confirmed that electronic filing combined with direct deposit is the fastest way to receive a refund. In most cases, taxpayers who choose this method receive their refunds within 21 days after the return is accepted. Paper returns usually take longer because they must be manually processed. If corrections are required or if a paper check is mailed, the wait time can extend to four weeks or more.

यह भी पढ़े:

IRS Tax Refund 2026 Schedule: Expected Dates, Refund Amounts, and Processing Time Explained

IRS Tax Refund 2026 Schedule: Expected Dates, Refund Amounts, and Processing Time Explained

Although the IRS continues to reduce the number of paper checks issued, some taxpayers still receive refunds by mail when direct deposit details are not provided. Those claiming the Earned Income Tax Credit or the Additional Child Tax Credit may face additional review time. These credits are subject to verification rules, and refunds connected to them are typically released later to ensure eligibility.

While most refunds are expected to be processed without major issues, some delays may occur. Staffing challenges, incorrect personal information, missing income documents, or calculation errors can slow down processing. Even so, official updates indicate that the majority of returns will be handled on schedule.

Refund amounts may be higher in 2026 due to recent tax law changes that extended earlier tax reductions. The standard deduction has increased to $15,750 for single filers and $31,500 for married couples filing jointly. Taxpayers aged 65 and older may also claim an additional $6,000 deduction, which lowers taxable income and may increase refund amounts.

यह भी पढ़े:

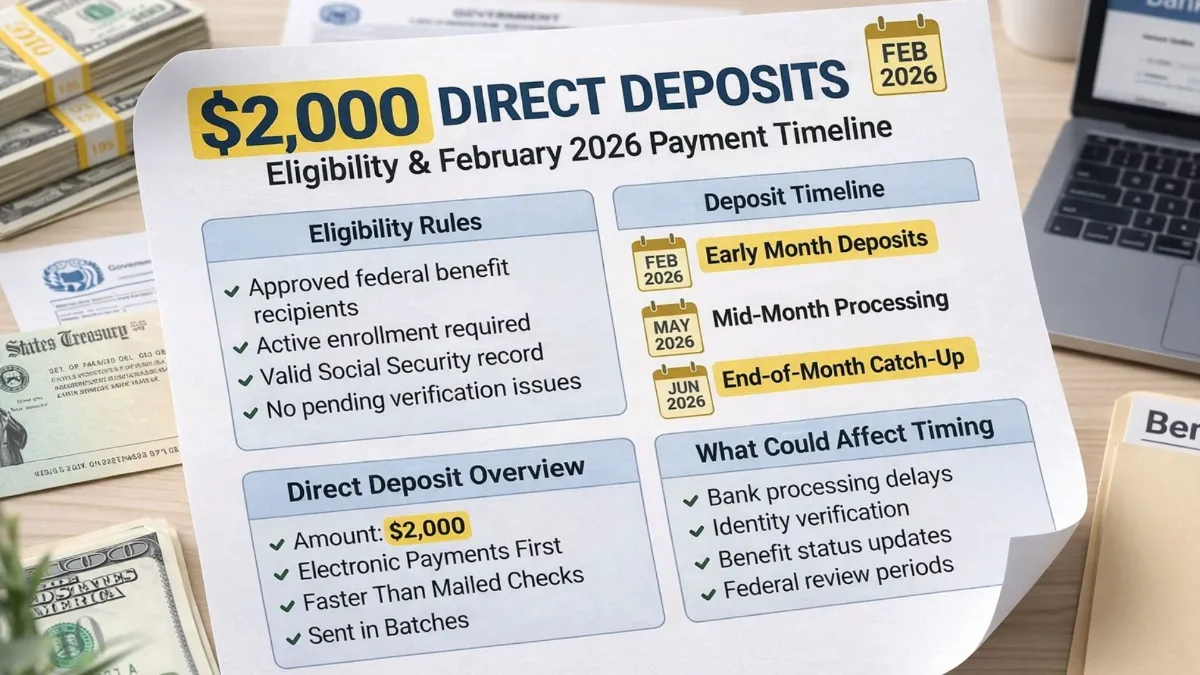

$2,000 Direct Deposit February 2026 Explained: Eligibility Criteria, Payment Timing, and Updates

$2,000 Direct Deposit February 2026 Explained: Eligibility Criteria, Payment Timing, and Updates

Taxpayers can track their refund status using the IRS online “Where’s My Refund?” tool, which provides updates throughout the processing stages.

Disclaimer: This article is for informational purposes only and does not provide tax, financial, or legal advice. Refund amounts, eligibility, and timelines depend on individual circumstances and official IRS rules. For accurate guidance, consult official IRS resources or a qualified tax professional.