As February 2026 approaches, millions of Americans who rely on Social Security are looking for clear information about their payment dates and possible benefit increases. For retirees, people with disabilities, and survivors, Social Security is essential income used to pay for housing, food, utilities, medical care, and insurance. With prices still higher than many households would like, even small changes in benefits can make a meaningful difference.

How Social Security Payments Are Scheduled

Social Security benefits are managed by the Social Security Administration, which follows a strict monthly payment system. Payments are usually sent electronically through direct deposit or the Direct Express card. Not everyone is paid on the same day. Instead, payment dates depend on when a person started receiving benefits and their date of birth.

यह भी पढ़े:

$2,000 IRS Payment in February 2026? What You Need to Know About Eligibility and Deposit Dates

$2,000 IRS Payment in February 2026? What You Need to Know About Eligibility and Deposit Dates

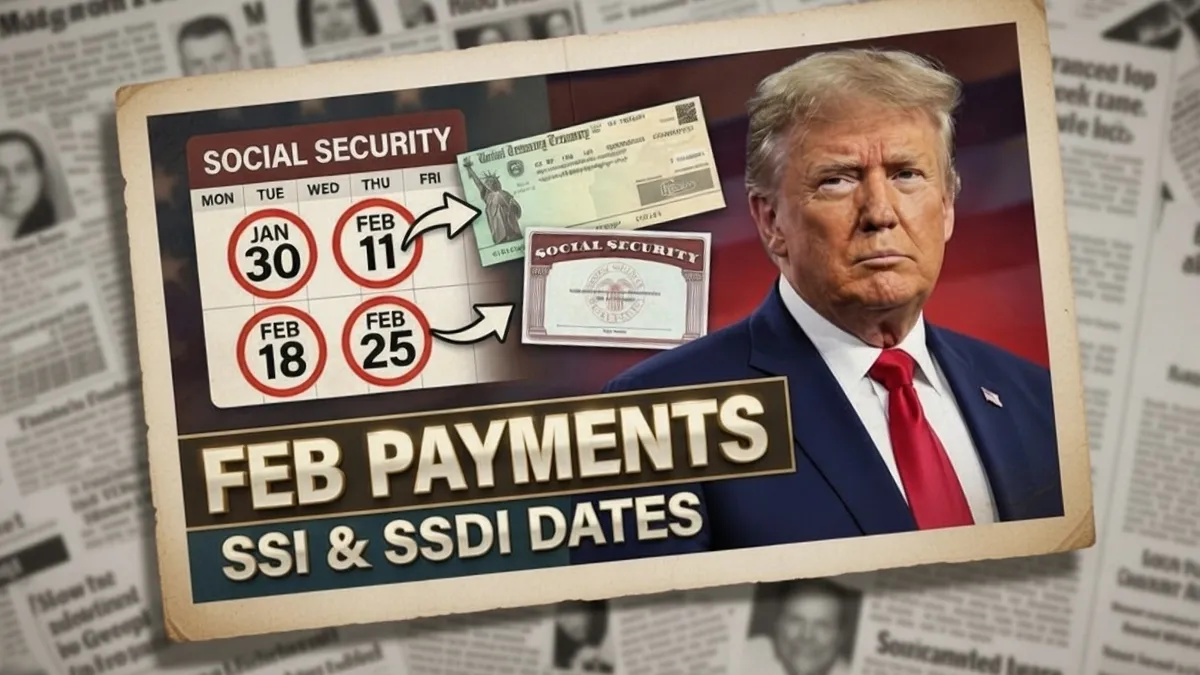

February 2026 Payment Dates

For February 2026, Social Security payments are expected to follow the same schedule used throughout the year. People who began receiving benefits before May 1997 typically receive their payments on the 3rd of the month. This group also includes individuals who receive both Social Security and Supplemental Security Income.

Beneficiaries who started receiving benefits after May 1997 are paid on Wednesdays. Those born between the 1st and 10th are paid on the second Wednesday of the month. People born between the 11th and 20th receive payments on the third Wednesday, while those born between the 21st and 31st are paid on the fourth Wednesday. If a payment date falls on a federal holiday, the payment is issued on the previous business day.

यह भी पढ़े:

IRS Tax Refund 2026 Guide: Processing Timelines, Key Rules, and What Taxpayers Should Expect

IRS Tax Refund 2026 Guide: Processing Timelines, Key Rules, and What Taxpayers Should Expect

SSI Payment Timing in February

Supplemental Security Income payments are normally sent on the 1st of each month. When the 1st falls on a weekend or holiday, the payment is issued earlier. These early payments are not extra money. They are simply calendar adjustments to ensure beneficiaries receive funds on time.

Understanding the 2026 COLA Increase

यह भी पढ़े:

February 2026 $2,000 IRS Payment Update: Are You Eligible and When Could the Money Arrive

February 2026 $2,000 IRS Payment Update: Are You Eligible and When Could the Money Arrive

The Cost-of-Living Adjustment, known as COLA, is an annual increase applied to Social Security benefits to help keep up with inflation. It is calculated using changes in consumer price data and is applied automatically. Beneficiaries do not need to apply or take any action to receive the increase.

The official COLA rate for 2026 has not yet been announced. This decision is usually made in October after inflation data from the third quarter is reviewed. Early estimates suggest the increase may be smaller than recent years but still positive. Once approved, the COLA will be included in payments starting January 2026, meaning February payments will already reflect the higher amount.

Why Your Net Payment May Look Different

Even with a COLA increase, the final amount deposited may change due to factors such as Medicare premium deductions, income updates for SSI recipients, or benefit adjustments. A change in the deposit amount does not always mean benefits were reduced.

Planning Ahead for February 2026

Knowing your payment date and understanding how COLA works can make budgeting easier. Reviewing official benefit notices and keeping personal information updated helps avoid surprises and delays.

Disclaimer

This article is for informational purposes only. Social Security payment schedules, benefit amounts, and COLA rates are subject to official announcements and individual circumstances. Readers should consult the Social Security Administration or a qualified professional for guidance specific to their situation.